Compound Interest – The Eighth Wonder of the World Explained for Beginner Investors

Albert Einstein reportedly called compound interest “the eighth wonder of the world,” saying: “He who understands it, earns it… he who doesn’t, pays it.”

Whether or not the quote is authentic, it captures a timeless truth: compound interest is one of the most powerful forces in personal finance.

Understanding it is the difference between building long-term wealth or falling into debt traps. Let’s break it down.

Table of Contents

How Compound Interest Works

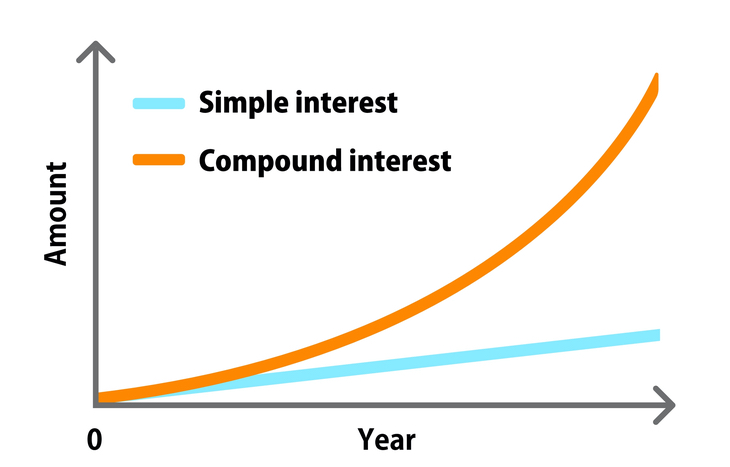

Compound interest is interest calculated not only on your original investment (the principal), but also on the interest that has already been added.

This creates an accelerating snowball effect where your money earns returns on previous returns.

The formula is simple:

A = P(1 + r/n)^(nt)

Where:

- A = final amount

- P = principal (initial investment)

- r = annual interest rate (decimal)

- n = number of compounding periods per year

- t = time in years

Examples of Compound Interest in Action

- The $1,000 Investment Story

If you invest $1,000 at 8% annual return:- Simple interest → ~$3,400 after 30 years

- Compound interest → ~$10,000 after 30 years

- The Tale of Two Savers

- Sarah invests $2,400 annually starting at 25 (9% return).

- Mary waits until 45 but doubles her contributions to $4,800 annually.

- Both invest a total of $96,000.

- Sarah ends up with $810,917, while Mary only has $245,568.

Lesson: Time matters more than amount. Starting early beats investing more later.

Example of how compound interest rewards early savers

The Rule of 72: Quick Way to Estimate Growth

The Rule of 72 helps you estimate how long it takes for money to double:

72 ÷ interest rate = doubling time (years).

Examples:

- 6% return → 12 years

- 8% return → 9 years

- 10% return → 7.2 years

Real Stories of Compound Interest

- Warren Buffett’s Fortune

The Oracle of Omaha credits his wealth to compound interest. Remarkably, over 90% of his fortune was built after age 65. - Benjamin Franklin’s Experiment

Franklin left just $4,400 (today’s value) invested at 5%. Two centuries later, it had grown to $6.5 million for Boston and Philadelphia.

The Dark Side: When Compound Interest Works Against You

Compound interest doesn’t just grow savings—it also amplifies debt.

- Credit Cards: Often compound daily at 20%+ APR.

- Example: A $1,000 balance at 22% APR grows to ~$1,225 after one year.

- Minimum Payments Trap: Keeps borrowers paying interest instead of reducing principal.

How to Harness Compound Interest as a Beginner

- Start Early: Even small contributions add up.

- Maximize Employer Match: Free money in your 401(k).

- Automate Contributions: Never miss a month.

- Pay Off High-Interest Debt: Don’t let compounding work against you.

- Increase Contributions Yearly: Even 1% per year compounds over decades.

As Charlie Munger said: “The first rule of compounding: Never interrupt it unnecessarily.”

Key Takeaways on Compound Interest

- Time > Timing: The earlier you start, the bigger the results.

- Small Differences Matter: A few percent higher return changes your future.

- Patience Wins: Stay invested, avoid interruptions.